Page 6 - Demo

P. 6

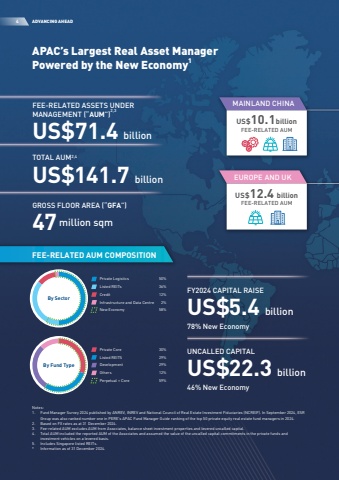

50%36%30%29%29%59%12%58%2%12%FEE-RELATED ASSETS UNDERMANAGEMENT (%u201cAUM%u201d)2,3US$71.4 billionTOTAL AUM2,4US$141.7 billionGROSS FLOORAREA (%u201cGFA%u201d)47million sqmFEE-RELATED AUM COMPOSITIONUS$10.1billionMAINLAND CHINAUS$12.4 billionEUROPE AND UKPrivate LogisticsListed REITsBy SectorPrivate CoreListed REITSDevelopmentPerpetual + CoreOthersBy Fund TypeFEE-RELATED AUMFEE-RELATED AUMFY2024 CAPITAL RAISEUS$5.4 billion78% New EconomyUNCALLED CAPITALUS$22.3 billion46% New EconomyNew EconomyInfrastructure and Data CentreCreditADVANCING AHEADNotes:1.Fund Manager Survey 2024 published by ANREV, INREV and National Council of Real Estate Investment Fiduciaries (NCREIF). In September 2024, ESR Group was also ranked number one in PERE%u2019s APAC Fund Manager Guide ranking of the top 50 private equity real estate fund managers in 2024.2.Based on FX rates as at 31 December 2024.3.Fee-related AUM excludes AUM from Associates, balance sheet investment properties and levered uncalled capital.4.Total AUM included the reported AUM of the Associates and assumed the value of the uncalled capital commitments in the private funds and investment vehicles on a levered basis.5.Includes Singapore listed REITs.*Information as of 31 December 2024.4APAC%u2019s Largest Real Asset ManagerPowered by the New Economy1