Page 4 - Demo

P. 4

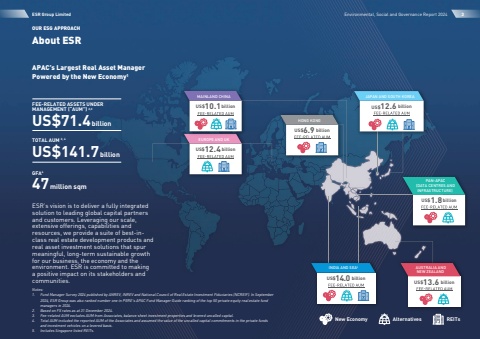

MAINLAND CHINAAUSTRALIA ANDNEW ZEALAND HONG KONGJAPAN AND SOUTH KOREAEUROPE AND UKINDIA AND SEA5PAN-APAC(DATA CENTRES ANDINFRASTRUCTURE) US$13.6billionUS$1.8billionUS$6.9billionUS$12.6billionUS$14.0billionUS$10.1billionUS$12.4billionNew EconomyAlternativesREITsEnvironmental, Social and Governance Report 20243OUR ESG APPROACHAbout ESRESR Group LimitedAPAC%u2019s Largest Real Asset Manager Powered by the New Economy1GFA447million sqmESR%u2019s vision is to deliver a fully integrated solution to leading global capital partners and customers. Leveraging our scale, extensive offerings, capabilities and resources, we provide a suite of best-inclass real estate development products and real asset investment solutions that spur meaningful, long-term sustainable growth for our business, the economy and the environment. ESR is committed to making a positive impact on its stakeholders and communities.FEE-RELATED ASSETS UNDER MANAGEMENT (%u201cAUM%u201d) 2,3US$71.4billionTOTAL AUM 2, 4US$141.7billionNotes:1.Fund Manager Survey 2024 published by ANREV, INREV and National Council of Real Estate Investment Fiduciaries (NCREIF). In September 2024, ESR Group was also ranked number one in PERE%u2019s APAC Fund Manager Guide ranking of the top 50 private equity real estate fund managers in 2024.2.Based on FX rates as at 31 December 2024.3.Fee-related AUM excludes AUM from Associates, balance sheet investment properties and levered uncalled capital.4.Total AUM included the reported AUM of the Associates and assumed the value of the uncalled capital commitments in the private funds and investment vehicles on a levered basis.5.Includes Singapore listed REITs.