Page 40 - Demo

P. 40

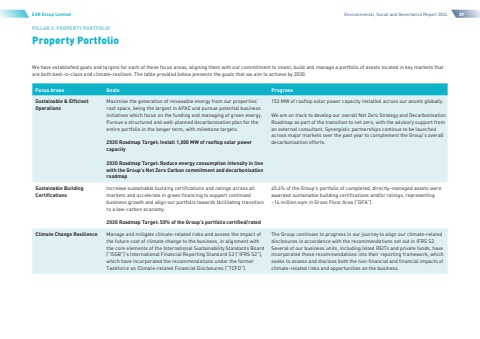

Property PortfolioPILLAR 2: PROPERTY PORTFOLIOESR Group LimitedEnvironmental, Social and Governance Report 202439We have established goals and targets for each of these focus areas, aligning them with our commitment to invest, build and manage a portfolio of assets located in key markets that are both best-in-class and climate-resilient. The table provided below presents the goals that we aim to achieve by 2030.Focus AreasGoalsProgressSustainable & Efficient OperationsMaximise the generation of renewable energy from our properties%u2019 roof space, being the largest in APAC and pursue potential business initiatives which focus on the funding and managing of green energy. Pursue a structured and well-planned decarbonisation plan for the entire portfolio in the longer term, with milestone targets.2030 Roadmap Target: Install 1,000 MW of rooftop solar power capacity2030 Roadmap Target: Reduce energy consumption intensity in line with the Group%u2019s Net Zero Carbon commitment and decarbonisation roadmap153 MW of rooftop solar power capacity installed across our assets globally.We are on track to develop our overall Net Zero Strategy and Decarbonisation Roadmap as part of the transition to net zero, with the advisory support from an external consultant. Synergistic partnerships continue to be launched across major markets over the past year to complement the Group%u2019s overall decarbonisation efforts.Sustainable Building CertificationsIncrease sustainable building certifications and ratings across all markets and accelerate in green financing to support continued business growth and align our portfolio towards facilitating transition to a low-carbon economy.2030 Roadmap Target: 50% of the Group%u2019s portfolio certified/rated45.4% of the Group%u2019s portfolio of completed, directly-managed assets were awarded sustainable building certifications and/or ratings, representing ~14 million sqm in Gross Floor Area (%u201cGFA%u201d).Climate Change ResilienceManage and mitigate climate-related risks and assess the impact of the future cost of climate change to the business, in alignment with the core elements of the International Sustainability Standards Board (%u201cISSB%u201d)%u2019s International Financial Reporting Standard S2 (%u201cIFRS S2%u201d), which have incorporated the recommendations under the former Taskforce on Climate-related Financial Disclosures (%u201cTCFD%u201d).The Group continues to progress in our journey to align our climate-related disclosures in accordance with the recommendations set out in IFRS S2. Several of our business units, including listed REITs and private funds, have incorporated these recommendations into their reporting framework, which seeks to assess and disclose both the non-financial and financial impacts of climate-related risks and opportunities on the business.