Page 130 - Demo

P. 130

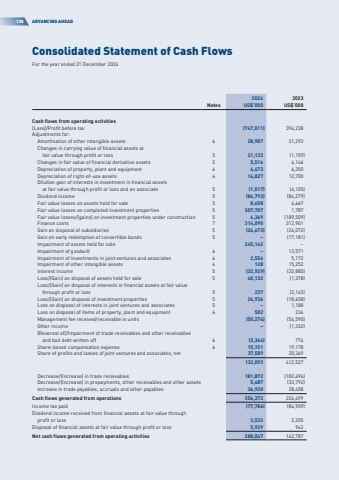

Consolidated Statement of Cash FlowsFor the year ended 31 December 2024128ADVANCING AHEAD20242023NotesUS$%u2019000US$%u2019000Cash flows from operating activities(Loss)/Profit before tax(747,011)394,238Adjustments for:Amortisation of other intangible assets628,98731,293Changes in carrying value of financial assets at fair value through profit or loss521,133(1,159)Changes in fair value of financial derivative assets55,5164,146Depreciation of property, plant and equipment66,4736,350Depreciation of right-of-use assets614,82712,700Dilution gain of interests in investment in financial assets at fair value through profit or loss and an associate5(1,017)(4,105)Dividend income5(86,792)(84,279)Fair value losses on assets held for sale58,6584,667Fair value losses on completed investment properties5307,7071,787Fair value losses/(gains) on investment properties under construction54,369(189,509)Finance costs7314,090312,901Gain on disposal of subsidiaries5(24,673)(24,072)Gain on early redemption of convertible bonds5%u2013(17,181)Impairment of assets held for sale245,142%u2013Impairment of goodwill6%u201313,571Impairment of investments in joint ventures and associates62,5565,172Impairment of other intangible assets612815,252Interest income5(32,929)(32,885)Loss/(Gain) on disposal of assets held for sale540,132(1,378)Loss/(Gain) on disposal of interests in financial assets at fair value through profit or loss5237(2,145)Loss/(Gain) on disposal of investment properties524,936(18,658)Loss on disposal of interests in joint ventures and associates5%u20131,188Loss on disposal of items of property, plant and equipment6502234Management fee received/receivable in units(50,274)(54,590)Other income%u2013(1,332)(Reversal of)/Impairment of trade receivables and other receivables and bad debt written off6(3,344)774Share-based compensation expense615,15119,178Share of profits and losses of joint ventures and associates, net37,58920,369132,093412,527Decrease/(Increase) in trade receivables181,872(182,694)Decrease/(Increase) in prepayments, other receivables and other assets5,487(33,792)Increase in trade payables, accruals and other payables36,92028,458Cash flows generated from operations356,372224,499Income tax paid(77,786)(84,909)Dividend income received from financial assets at fair value throughprofit or loss3,5322,255Disposal of financial assets at fair value through profit or loss5,929942Net cash flows generated from operating activities288,047142,787