Page 175 - Demo

P. 175

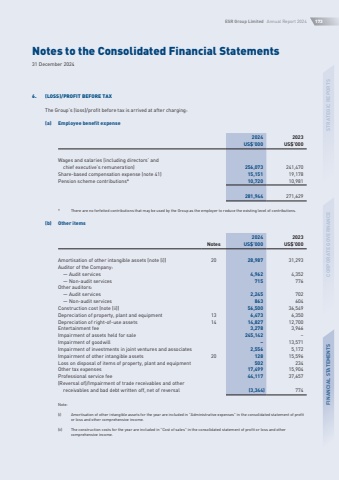

Notes to the Consolidated Financial Statements31 December 2024ESR Group Limited Annual Report 2024173STRATEGIC REPORTSCORPORATE GOVERNANCEFINANCIAL STATEMENTS6.(LOSS)/PROFIT BEFORE TAXThe Group%u2019s (loss)/profit before tax is arrived at after charging:(a)Employee benefit expense20242023US$%u2019000US$%u2019000Wages and salaries (including directors%u2019 and chief executive%u2019s remuneration)256,073241,470Share-based compensation expense (note 41)15,15119,178Pension scheme contributions*10,72010,981281,944271,629*There are no forfeited contributions that may be used by the Group as the employer to reduce the existing level of contributions.(b)Other items20242023NotesUS$%u2019000US$%u2019000Amortisation of other intangible assets (note (i))2028,98731,293Auditor of the Company:%u2014 Audit services4,9624,352%u2014 Non-audit services715776Other auditors:%u2014 Audit services2,245702%u2014 Non-audit services863604Construction cost (note (ii))56,50036,549Depreciation of property, plant and equipment136,4736,350Depreciation of right-of-use assets1414,82712,700Entertainment fee3,2783,966Impairment of assets held for sale245,142%u2013Impairment of goodwill%u201313,571Impairment of investments in joint ventures and associates2,5565,172Impairment of other intangible assets2012815,596Loss on disposal of items of property, plant and equipment502234Other tax expenses17,49915,904Professional service fee44,11737,657(Reversal of)/Impairment of trade receivables and other receivables and bad debt written off, net of reversal(3,344)774Note:(i)Amortisation of other intangible assets for the year are included in %u201cAdministrative expenses%u201d in the consolidated statement of profit or loss and other comprehensive income.(ii)The construction costs for the year are included in %u201cCost of sales%u201d in the consolidated statement of profit or loss and other comprehensive income.