Page 180 - Demo

P. 180

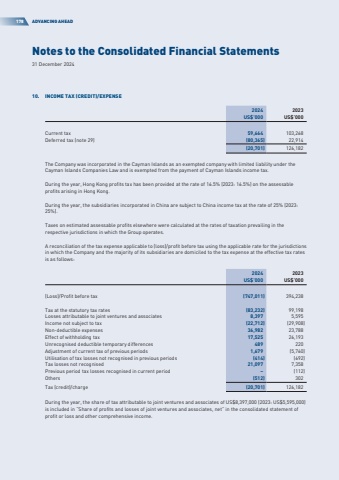

Notes to the Consolidated Financial Statements31 December 2024178ADVANCING AHEAD10.INCOME TAX (CREDIT)/EXPENSE20242023US$%u2019000US$%u2019000Current tax59,664103,268Deferred tax (note 29)(80,365)22,914(20,701)126,182The Company was incorporated in the Cayman Islands as an exempted company with limited liability under the Cayman Islands Companies Law and is exempted from the payment of Cayman Islands income tax.During the year, Hong Kong profits tax has been provided at the rate of 16.5% (2023: 16.5%) on the assessable profits arising in Hong Kong.During the year, the subsidiaries incorporated in China are subject to China income tax at the rate of 25% (2023: 25%).Taxes on estimated assessable profits elsewhere were calculated at the rates of taxation prevailing in the respective jurisdictions in which the Group operates.A reconciliation of the tax expense applicable to (loss)/profit before tax using the applicable rate for the jurisdictions in which the Company and the majority of its subsidiaries are domiciled to the tax expense at the effective tax rates is as follows:20242023US$%u2019000US$%u2019000(Loss)/Profit before tax(747,011)394,238Tax at the statutory tax rates(83,232)99,198Losses attributable to joint ventures and associates8,3975,595Income not subject to tax(22,712)(29,908)Non-deductible expenses36,98223,788Effect of withholding tax17,52526,193Unrecognised deductible temporary differences489220Adjustment of current tax of previous periods1,679(5,760)Utilisation of tax losses not recognised in previous periods(414)(692)Tax losses not recognised21,0977,358Previous period tax losses recognised in current period%u2013(112)Others(512)302Tax (credit)/charge(20,701)126,182Duringtheyear,theshareoftaxattributabletojointventuresandassociatesofUS$8,397,000(2023:US$5,595,000)is included in %u201cShare of profits and losses of joint ventures and associates, net%u201d in the consolidated statement of profit or loss and other comprehensive income.