Page 211 - Demo

P. 211

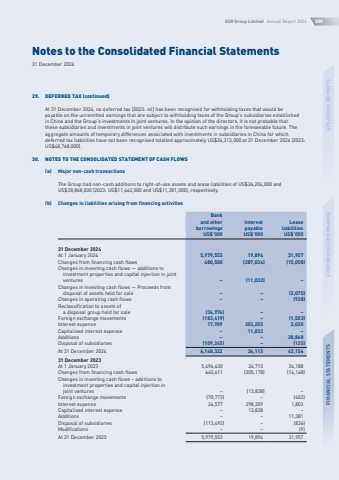

Notes to the Consolidated Financial Statements31 December 2024ESR Group Limited Annual Report 2024209STRATEGIC REPORTSCORPORATE GOVERNANCEFINANCIAL STATEMENTS29.DEFERRED TAX (continued)At 31 December 2024, no deferred tax (2023: nil) has been recognised for withholding taxes that would be payable on the unremitted earnings that are subject to withholding taxes of the Group%u2019s subsidiaries established in China and the Group%u2019s investments in joint ventures. In the opinion of the directors, it is not probable that these subsidiaries and investments in joint ventures will distribute such earnings in the foreseeable future. The aggregate amounts of temporary differences associated with investments in subsidiaries in China for which deferred tax liabilities have not been recognised totalled approximately US$26,313,000 at 31 December 2024 (2023: US$48,768,000).30.NOTES TO THE CONSOLIDATED STATEMENT OF CASH FLOWS(a)Major non-cash transactionsThe Group had non-cash additions to right-of-use assets and lease liabilities of US$26,204,000 and US$28,868,000 (2023: US$11,462,000 and US$11,381,000), respectively.(b)Changes in liabilities arising from financing activitiesBank and other borrowingsInterest payableLease liabilitiesUS$%u2019000US$%u2019000US$%u201900031 December 2024At 1 January 20245,979,55319,89431,957Changes from financing cash flows480,500(287,034)(15,058)Changes in investing cash flows %u2014 additions to investment properties and capital injection in joint ventures%u2013(11,032)%u2013Changes in investing cash flows %u2014 Proceeds from disposal of assets held for sale%u2013%u2013(2,075)Changes in operating cash flows%u2013%u2013(928)Reclassification to assets of a disposal group held for sale(36,976)%u2013%u2013Foreign exchange movements(183,419)%u2013(1,503)Interest expense17,909303,2552,020Capitalised interest expense%u201311,032%u2013Additions%u2013%u201328,868Disposal of subsidiaries(109,245)%u2013(125)At 31 December 20246,148,32236,11543,15631 December 2023At 1 January 20235,496,63026,71334,188Changes from financing cash flows640,611(305,178)(14,168)Changes in investing cash flows %u2013 additions to investment properties and capital injection in joint ventures(13,838)Foreign exchange movements(70,773)(402)Interest expense26,577298,3591,803Capitalised interest expense13,838Additions11,381Disposal of subsidiaries(113,492)(836)Modifications(9)At 31 December 20235,979,55319,89431,957