Page 207 - Demo

P. 207

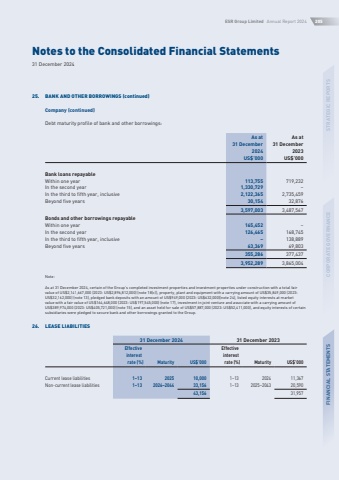

Notes to the Consolidated Financial Statements31 December 2024ESR Group Limited Annual Report 2024205STRATEGIC REPORTSCORPORATE GOVERNANCEFINANCIAL STATEMENTS25.BANK AND OTHER BORROWINGS (continued)Company (continued)Debt maturity profile of bank and other borrowings:As at 31 DecemberAs at 31 December20242023US$%u2019000US$%u2019000Bank loans repayableWithin one year113,755719,232In the second year1,330,729%u2013In the third to fifth year, inclusive2,122,3652,735,459Beyond five years30,15432,8763,597,0033,487,567Bonds and other borrowings repayableWithin one year165,452%u2013In the second year126,465168,745In the third to fifth year, inclusive%u2013138,889Beyond five years63,36969,803355,286377,4373,952,2893,865,004Note:As at 31 December 2024, certain of the Group%u2019s completed investment properties and investment properties under construction with a total fair valueofUS$2,141,667,000(2023:US$2,896,812,000)(note18(c)),property,plantandequipmentwithacarryingamountofUS$35,849,000(2023:US$32,162,000) (note 13), pledged bank deposits with an amount of US$949,000 (2023: US$632,000)(note 24), listed equity interests at market valuewithafairvalueofUS$164,648,000(2023:US$197,545,000)(note17),investmentinjointventureandassociatewithacarryingamountofUS$389,974,000(2023:US$405,721,000)(note15),andanassetheldforsaleofUS$57,887,000(2023:US$52,411,000),andequityinterestsofcertainsubsidiaries were pledged to secure bank and other borrowings granted to the Group.26.LEASE LIABILITIES31 December 202431 December 2023Effective interest rate (%)MaturityUS$%u2019000Effective interest rate (%)MaturityUS$%u2019000Current lease liabilities1%u201313202510,0001%u201313202411,367Non-current lease liabilities1%u2013132026%u2013204433,1561%u2013132025%u2013204320,59043,15631,957