Page 244 - Demo

P. 244

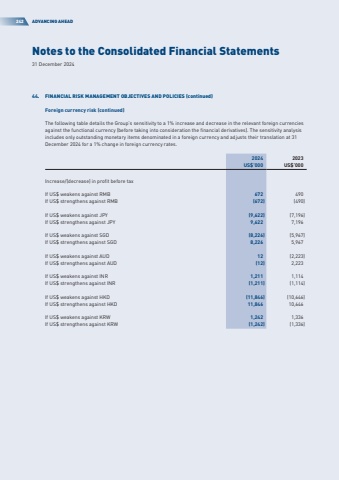

Notes to the Consolidated Financial Statements31 December 2024242ADVANCING AHEAD44.FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (continued)Foreign currency risk (continued)The following table details the Group%u2019s sensitivity to a 1% increase and decrease in the relevant foreign currencies against the functional currency (before taking into consideration the financial derivatives). The sensitivity analysis includes only outstanding monetary items denominated in a foreign currency and adjusts their translation at 31 December 2024 for a 1% change in foreign currency rates.20242023US$%u2019000US$%u2019000Increase/(decrease) in profit before taxIf US$ weakens against RMB672490If US$ strengthens against RMB(672)(490)If US$ weakens against JPY(9,622)(7,196)If US$ strengthens against JPY9,6227,196If US$ weakens against SGD(8,226)(5,967)If US$ strengthens against SGD8,2265,967If US$ weakens against AUD12(2,223)If US$ strengthens against AUD(12)2,223If US$ weakens against INR1,2111,114If US$ strengthens against INR(1,211)(1,114)If US$ weakens against HKD(11,846)(10,646)If US$ strengthens against HKD11,84610,646If US$ weakens against KRW1,2421,336If US$ strengthens against KRW(1,242)(1,336)