Page 246 - Demo

P. 246

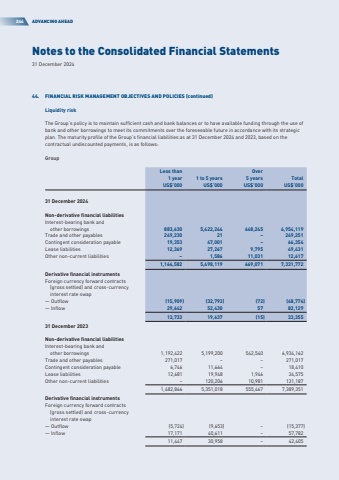

Notes to the Consolidated Financial Statements31 December 2024244ADVANCING AHEAD44.FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (continued)Liquidity riskThe Group%u2019s policy is to maintain sufficient cash and bank balances or to have available funding through the use of bank and other borrowings to meet its commitments over the foreseeable future in accordance with its strategic plan. The maturity profile of the Group%u2019s financial liabilities as at 31 December 2024 and 2023, based on the contractual undiscounted payments, is as follows:GroupLess than 1 year1 to 5 yearsOver 5 yearsTotalUS$%u2019000US$%u2019000US$%u2019000US$%u201900031 December 2024Non-derivative financial liabilitiesInterest-bearing bank and other borrowings883,6305,422,244648,2456,954,119Trade and other payables249,23021%u2013249,251Contingent consideration payable19,35347,001%u201366,354Lease liabilities12,36927,2679,79549,431Other non-current liabilities%u20131,58611,03112,6171,164,5825,498,119669,0717,331,772Derivative financial instrumentsForeign currency forward contracts (gross settled) and cross-currency interest rate swap%u2014 Outflow(15,909)(32,793)(72)(48,774)%u2014 Inflow29,64252,4305782,12913,73319,637(15)33,35531 December 2023Non-derivative financial liabilitiesInterest-bearing bank and other borrowings1,192,4225,199,200542,5406,934,162Trade and other payables271,017271,017Contingent consideration payable6,74611,66418,410Lease liabilities12,68119,9481,94634,575Other non-current liabilities120,20610,981131,1871,482,8665,351,018555,4677,389,351Derivative financial instrumentsForeign currency forward contracts (gross settled) and cross-currency interest rate swap%u2014 Outflow(5,724)(9,653)%u2013(15,377)%u2014 Inflow17,17140,611%u201357,78211,44730,958%u201342,405