Page 72 - Demo

P. 72

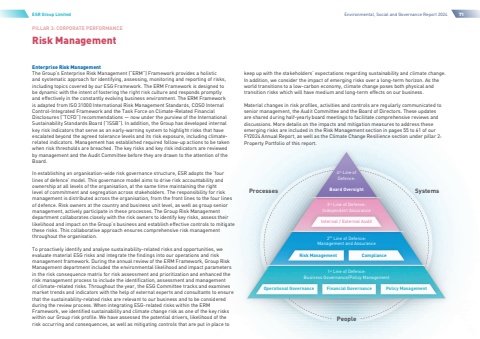

PILLAR 3: CORPORATE PERFORMANCERisk ManagementESR Group LimitedEnvironmental, Social and Governance Report 202471PeopleProcessesSystems4th Line ofDefence:Board Oversight3rd Line of Defence:Independent AssuranceInternal / External Audit2nd Line of Defence:Management and AssuranceRisk ManagementCompliance1st Line of Defence:Business Governance/Policy ManagementOperational Governance Financial Governance Policy Managementkeep up with the stakeholders%u2019 expectations regarding sustainability and climate change. In addition, we consider the impact of emerging risks over a long-term horizon. As the world transitions to a low-carbon economy, climate change poses both physical and transition risks which will have medium and long-term effects on our business.Material changes in risk profiles, activities and controls are regularly communicated to senior management, the Audit Committee and the Board of Directors. These updates are shared during half-yearly board meetings to facilitate comprehensive reviews and discussions. More details on the impacts and mitigation measures to address these emerging risks are included in the Risk Management section in pages 55 to 61 of our FY2024 Annual Report, as well as the Climate Change Resilience section under pillar 2: Property Portfolio of this report.Enterprise Risk ManagementThe Group%u2019s Enterprise Risk Management (%u201cERM%u201d) Framework provides a holistic and systematic approach for identifying, assessing, monitoring and reporting of risks, including topics covered by our ESG Framework. The ERM Framework is designed to be dynamic with the intent of fostering the right risk culture and responds promptly and effectively in the constantly evolving business environment. The ERM Framework is adapted from ISO 31000 International Risk Management Standards, COSO Internal Control-Integrated Framework and the Task Force on Climate-Related Financial Disclosures (%u201cTCFD%u201d) recommendations %u2014 now under the purview of the International Sustainability Standards Board (%u201cISSB%u201d). In addition, the Group has developed internal key risk indicators that serve as an early-warning system to highlight risks that have escalated beyond the agreed tolerance levels and its risk exposure, including climaterelated indicators. Management has established required follow-up actions to be taken when risk thresholds are breached. The key risks and key risk indicators are reviewed by management and the Audit Committee before they are drawn to the attention of the Board.In establishing an organisation-wide risk governance structure, ESR adopts the %u2018four lines of defence%u2019 model. This governance model aims to drive risk accountability and ownership at all levels of the organisation, at the same time maintaining the right level of commitment and segregation across stakeholders. The responsibility for risk management is distributed across the organisation, from the front lines to the four lines of defence. Risk owners at the country and business unit level, as well as group senior management, actively participate in these processes. The Group Risk Management department collaborates closely with the risk owners to identify key risks, assess their likelihood and impact on the Group%u2019s business and establish effective controls to mitigate these risks. This collaborative approach ensures comprehensive risk management throughout the organisation.To proactively identify and analyse sustainability-related risks and opportunities, we evaluate material ESG risks and integrate the findings into our operations and risk management framework. During the annual review of the ERM Framework, Group Risk Management department included the environmental likelihood and impact parameters in the risk consequence matrix for risk assessment and prioritization and enhanced the risk management process to include the identification, assessment and management of climate-related risks. Throughout the year, the ESG Committee tracks and examines market trends and indicators with the help of external experts and consultants to ensure that the sustainability-related risks are relevant to our business and to be considered during the review process. When integrating ESG-related risks within the ERM Framework, we identified sustainability and climate change risk as one of the key risks within our Group risk profile. We have assessed the potential drivers, likelihood of the risk occurring and consequences, as well as mitigating controls that are put in place to