Page 249 - Demo

P. 249

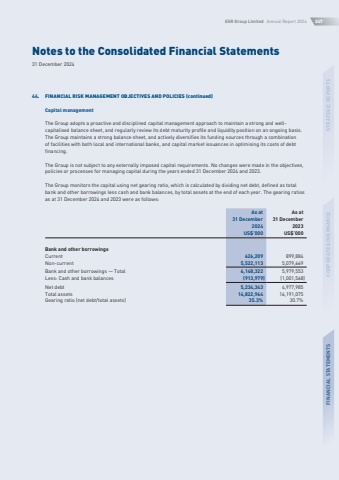

Notes to the Consolidated Financial Statements31 December 2024ESR Group Limited Annual Report 2024247STRATEGIC REPORTSCORPORATE GOVERNANCEFINANCIAL STATEMENTS44.FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (continued)Capital managementThe Group adopts a proactive and disciplined capital management approach to maintain a strong and wellcapitalised balance sheet, and regularly review its debt maturity profile and liquidity position on an ongoing basis. The Group maintains a strong balance sheet, and actively diversifies its funding sources through a combination of facilities with both local and international banks, and capital market issuances in optimising its costs of debt financing.The Group is not subject to any externally imposed capital requirements. No changes were made in the objectives, policies or processes for managing capital during the years ended 31 December 2024 and 2023.The Group monitors the capital using net gearing ratio, which is calculated by dividing net debt, defined as total bank and other borrowings less cash and bank balances, by total assets at the end of each year. The gearing ratios as at 31 December 2024 and 2023 were as follows:As at 31 DecemberAs at 31 December20242023US$%u2019000US$%u2019000Bank and other borrowingsCurrent626,209899,884Non-current5,522,1135,079,669Bank and other borrowings %u2014 Total6,148,3225,979,553Less: Cash and bank balances(913,979)(1,001,568)Net debt5,234,3434,977,985Total assets14,822,96416,191,075Gearing ratio (net debt/total assets)35.3%30.7%