Page 63 - Demo

P. 63

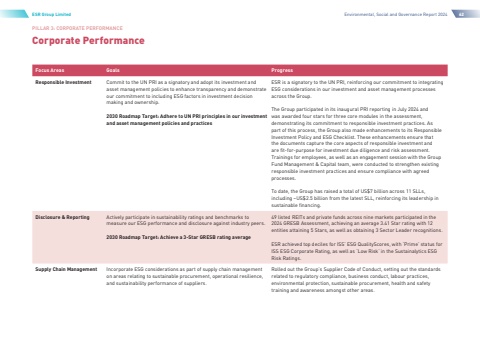

PILLAR 3: CORPORATE PERFORMANCECorporate PerformanceESR Group LimitedEnvironmental, Social and Governance Report 202462Focus AreasGoalsProgressResponsible InvestmentCommit to the UN PRI as a signatory and adopt its investment and asset management policies to enhance transparency and demonstrate our commitment to including ESG factors in investment decision making and ownership.2030 Roadmap Target: Adhere to UN PRI principles in our investment and asset management policies and practicesESR is a signatory to the UN PRI, reinforcing our commitment to integrating ESG considerations in our investment and asset management processes across the Group.The Group participated in its inaugural PRI reporting in July 2024 and was awarded four stars for three core modules in the assessment, demonstrating its commitment to responsible investment practices. As part of this process, the Group also made enhancements to its Responsible Investment Policy and ESG Checklist. These enhancements ensure that the documents capture the core aspects of responsible investment and are fit-for-purpose for investment due diligence and risk assessment. Trainings for employees, as well as an engagement session with the Group Fund Management & Capital team, were conducted to strengthen existing responsible investment practices and ensure compliance with agreed processes.To date, the Group has raised a total of US$7 billion across 11 SLLs, including ~US$2.5 billion from the latest SLL, reinforcing its leadership in sustainable financing.Disclosure & ReportingActively participate in sustainability ratings and benchmarks to measure our ESG performance and disclosure against industry peers.2030 Roadmap Target: Achieve a 3-Star GRESB rating average49 listed REITs and private funds across nine markets participated in the 2024 GRESB Assessment, achieving an average 3.41 Star rating with 12 entities attaining 5 Stars, as well as obtaining 3 Sector Leader recognitions.ESR achieved top deciles for ISS%u2019 ESG QualityScores, with %u2018Prime%u2019 status for ISS ESG Corporate Rating, as well as %u2018Low Risk%u2019 in the Sustainalytics ESG Risk Ratings.Supply Chain ManagementIncorporate ESG considerations as part of supply chain management on areas relating to sustainable procurement, operational resilience, and sustainability performance of suppliers.Rolled out the Group%u2019s Supplier Code of Conduct, setting out the standards related to regulatory compliance, business conduct, labour practices, environmental protection, sustainable procurement, health and safety training and awareness amongst other areas.