Page 57 - Demo

P. 57

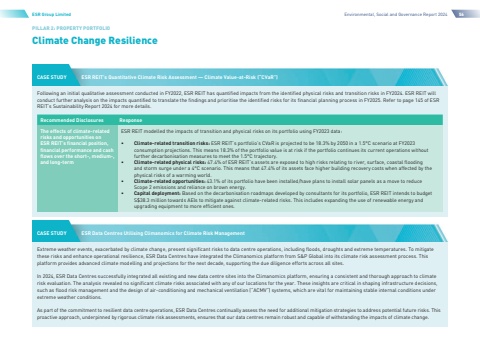

Climate Change ResiliencePILLAR 2: PROPERTY PORTFOLIOESR Group LimitedEnvironmental, Social and Governance Report 202456CASE STUDYCASE STUDYESR Data Centres Utilising Climanomics for Climate Risk ManagementESR REIT%u2019s Quantitative Climate Risk Assessment %u2014 Climate Value-at-Risk (%u201cCVaR%u201d)Extreme weather events, exacerbated by climate change, present significant risks to data centre operations, including floods, droughts and extreme temperatures. To mitigate these risks and enhance operational resilience, ESR Data Centres have integrated the Climanomics platform from S&P Global into its climate risk assessment process. This platform provides advanced climate modelling and projections for the next decade, supporting the due diligence efforts across all sites.In 2024, ESR Data Centres successfully integrated all existing and new data centre sites into the Climanomics platform, ensuring a consistent and thorough approach to climate risk evaluation. The analysis revealed no significant climate risks associated with any of our locations for the year. These insights are critical in shaping infrastructure decisions, such as flood risk management and the design of air-conditioning and mechanical ventilation (%u201cACMV%u201d) systems, which are vital for maintaining stable internal conditions under extreme weather conditions.As part of the commitment to resilient data centre operations, ESR Data Centres continually assess the need for additional mitigation strategies to address potential future risks. This proactive approach, underpinned by rigorous climate risk assessments, ensures that our data centres remain robust and capable of withstanding the impacts of climate change.Following an initial qualitative assessment conducted in FY2022, ESR REIT has quantified impacts from the identified physical risks and transition risks in FY2024. ESR REIT will conduct further analysis on the impacts quantified to translate the findings and prioritise the identified risks for its financial planning process in FY2025. Refer to page 145 of ESR REIT%u2019s Sustainability Report 2024 for more details.Recommended Disclosures ResponseThe effects of climate-related risks and opportunities on ESR REIT%u2019s financial position, financial performance and cash flows over the short-, medium-, and long-termESR REIT modelled the impacts of transition and physical risks on its portfolio using FY2023 data:%u2022%u0009Climate-related transition risks: ESR REIT%u2019s portfolio%u2019s CVaR is projected to be 18.3% by 2050 in a 1.5%u00b0C scenario at FY2023 consumption projections. This means 18.3% of the portfolio value is at risk if the portfolio continues its current operations without further decarbonisation measures to meet the 1.5%u00b0C trajectory.%u2022%u0009Climate-related physical risks: 47.4% of ESR REIT%u2019s assets are exposed to high risks relating to river, surface, coastal flooding and storm surge under a 4%u00b0C scenario. This means that 47.4% of its assets face higher building recovery costs when affected by the physical risks of a warming world.%u2022%u0009Climate-related opportunities: 43.1% of its portfolio have been installed/have plans to install solar panels as a move to reduce Scope 2 emissions and reliance on brown energy.%u2022%u0009Capital deployment: Based on the decarbonisation roadmaps developed by consultants for its portfolio, ESR REIT intends to budget S$38.3 million towards AEls to mitigate against climate-related risks. This includes expanding the use of renewable energy and upgrading equipment to more efficient ones.