Page 79 - Demo

P. 79

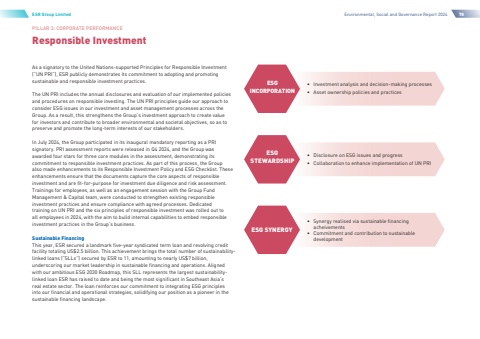

PILLAR 3: CORPORATE PERFORMANCEResponsible InvestmentESR Group LimitedEnvironmental, Social and Governance Report 202478%u2022 Investment analysis and decision-making processes%u2022 Asset ownership policies and practicesESGINCORPORATION%u2022 Disclosure on ESG issues and progress%u2022 Collaboration to enhance implementation of UN PRIESGSTEWARDSHIP%u2022 Synergy realised via sustainable financing acheivements%u2022 Commitment and contribution to sustainabledevelopmentESG SYNERGYAs a signatory to the United Nations-supported Principles for Responsible Investment (%u201cUN PRI%u201d), ESR publicly demonstrates its commitment to adopting and promoting sustainable and responsible investment practices.The UN PRI includes the annual disclosures and evaluation of our implemented policies and procedures on responsible investing. The UN PRI principles guide our approach to consider ESG issues in our investment and asset management processes across the Group. As a result, this strengthens the Group%u2019s investment approach to create value for investors and contribute to broader environmental and societal objectives, so as to preserve and promote the long-term interests of our stakeholders.In July 2024, the Group participated in its inaugural mandatory reporting as a PRI signatory. PRI assessment reports were released in Q4 2024, and the Group was awarded four stars for three core modules in the assessment, demonstrating its commitment to responsible investment practices. As part of this process, the Group also made enhancements to its Responsible Investment Policy and ESG Checklist. These enhancements ensure that the documents capture the core aspects of responsible investment and are fit-for-purpose for investment due diligence and risk assessment. Trainings for employees, as well as an engagement session with the Group Fund Management & Capital team, were conducted to strengthen existing responsible investment practices and ensure compliance with agreed processes. Dedicated training on UN PRI and the six principles of responsible investment was rolled out to all employees in 2024, with the aim to build internal capabilities to embed responsible investment practices in the Group%u2019s business.Sustainable FinancingThis year, ESR secured a landmark five-year syndicated term loan and revolving credit facility totaling US$2.5 billion. This achievement brings the total number of sustainabilitylinked loans (%u201cSLLs%u201d) secured by ESR to 11, amounting to nearly US$7 billion, underscoring our market leadership in sustainable financing and operations. Aligned with our ambitious ESG 2030 Roadmap, this SLL represents the largest sustainabilitylinked loan ESR has raised to date and being the most significant in Southeast Asia%u2019s real estate sector. The loan reinforces our commitment to integrating ESG principles into our financial and operational strategies, solidifying our position as a pioneer in the sustainable financing landscape.