Page 77 - Demo

P. 77

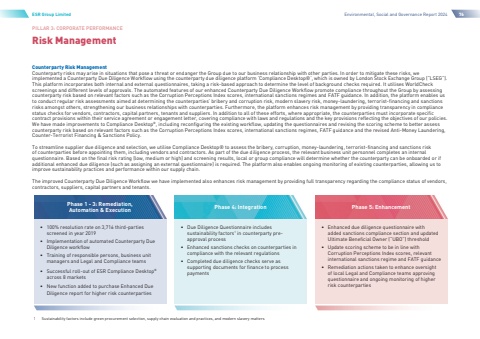

PILLAR 3: CORPORATE PERFORMANCERisk ManagementESR Group LimitedEnvironmental, Social and Governance Report 202476Counterparty Risk ManagementCounterparty risks may arise in situations that pose a threat or endanger the Group due to our business relationship with other parties. In order to mitigate these risks, we implemented a Counterparty Due Diligence Workflow using the counterparty due diligence platform %u2018Compliance Desktop%u00ae%u2019, which is owned by London Stock Exchange Group (%u201cLSEG%u201d). This platform incorporates both internal and external questionnaires, taking a risk-based approach to determine the level of background checks required. It utilises WorldCheck screenings and different levels of approvals. The automated features of our enhanced Counterparty Due Diligence Workflow promote compliance throughout the Group by assessing counterparty risk based on relevant factors such as the Corruption Perceptions Index scores, international sanctions regimes and FATF guidance. In addition, the platform enables us to conduct regular risk assessments aimed at determining the counterparties%u2019 bribery and corruption risk, modern slavery risk, money-laundering, terrorist-financing and sanctions risks amongst others, strengthening our business relationships with counterparties. Furthermore, the platform enhances risk management by providing transparency in compliance status checks for vendors, contractors, capital partners, tenants and suppliers. In addition to all of these efforts, where appropriate, the counterparties must incorporate specific contract provisions within their service agreement or engagement letter, covering compliance with laws and regulations and the key provisions reflecting the objectives of our policies. We have made improvements to Compliance Desktop%u00ae, including reconfiguring the existing workflow, updating the questionnaires and revising the scoring scheme to better assess counterparty risk based on relevant factors such as the Corruption Perceptions Index scores, international sanctions regimes, FATF guidance and the revised Anti-Money Laundering, Counter-Terrorist Financing & Sanctions Policy.To streamline supplier due diligence and selection, we utilise Compliance Desktop%u00ae to assess the bribery, corruption, money-laundering, terrorist-financing and sanctions risk of counterparties before appointing them, including vendors and contractors. As part of the due diligence process, the relevant business unit personnel completes an internal questionnaire. Based on the final risk rating (low, medium or high) and screening results, local or group compliance will determine whether the counterparty can be onboarded or if additional enhanced due diligence (such as assigning an external questionnaire) is required. The platform also enables ongoing monitoring of existing counterparties, allowing us to improve sustainability practices and performance within our supply chain.The improved Counterparty Due Diligence Workflow we have implemented also enhances risk management by providing full transparency regarding the compliance status of vendors, contractors, suppliers, capital partners and tenants.Phase 1 - 3: Remediation,Automation & Execution%u2022 100% resolution rate on 3,716 third-partiesscreened in year 2019%u2022 Implementation of automated Counterparty DueDiligence workflow%u2022 Training of responsible persons, business unitmanagers and Legal and Compliance teams%u2022 New function added to purchase Enhanced DueDiligence report for higher risk counterparties%u2022 Due Diligence Questionnaire includessustainability factors1 in counterparty preapproval process%u2022 Enhanced sanctions checks on counterparties incompliance with the relevant regulations%u2022 Completed due diligence checks serve assupporting documents for finance to processpayments%u2022 Enhanced due diligence questionnaire withadded sanctions compliance section and updatedUltimate Beneficial Owner (%u201cUBO%u201d) threshold%u2022 Update scoring scheme to be in line withCorruption Perceptions Index scores, relevantinternational sanctions regime and FATFguidance%u2022 Remediation actions taken to enhance oversightof local Legal and Compliance teams approvingquestionnaire and ongoing monitoring of higherrisk counterparties%u2022 Successful roll-out of ESR Compliance Desktop%u00aeacross 8 marketsPhase 4: IntegrationPhase 5: Enhancement1 Sustainability factors include green procurement selection, supply chain evaluation and practices, and modern slavery matters