Page 190 - Demo

P. 190

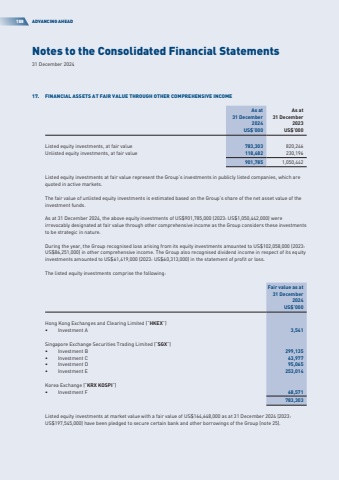

Notes to the Consolidated Financial Statements31 December 2024188ADVANCING AHEAD17.FINANCIAL ASSETS AT FAIR VALUE THROUGH OTHER COMPREHENSIVE INCOMEAs at31 December2024As at31 December2023US$%u2019000US$%u2019000Listed equity investments, at fair value783,303820,246Unlisted equity investments, at fair value118,482230,196901,7851,050,442Listed equity investments at fair value represent the Group%u2019s investments in publicly listed companies, which are quoted in active markets.The fair value of unlisted equity investments is estimated based on the Group%u2019s share of the net asset value of the investment funds.Asat31December2024,theaboveequityinvestmentsofUS$901,785,000(2023:US$1,050,442,000)wereirrevocably designated at fair value through other comprehensive income as the Group considers these investments to be strategic in nature.During the year, the Group recognised loss arising from its equity investments amounted to US$102,058,000 (2023: US$86,251,000) in other comprehensive income. The Group also recognised dividend income in respect of its equity investments amounted to US$61,419,000 (2023: US$60,313,000) in the statement of profit or loss.The listed equity investments comprise the following:Fair value as at31 December2024US$%u2019000Hong Kong Exchanges and Clearing Limited (%u201cHKEX%u201d)%u2022%u0009 InvestmentA3,541Singapore Exchange Securities Trading Limited (%u201cSGX%u201d)%u2022%u0009 InvestmentB299,135%u2022%u0009 InvestmentC63,977%u2022%u0009 InvestmentD95,065%u2022%u0009 InvestmentE253,014Korea Exchange (%u201cKRX KOSPI%u201d)%u2022%u0009 InvestmentF68,571783,303Listed equity investments at market value with a fair value of US$164,648,000 as at 31 December 2024 (2023: US$197,545,000)havebeenpledgedtosecurecertainbankandotherborrowingsoftheGroup(note25).