Page 193 - Demo

P. 193

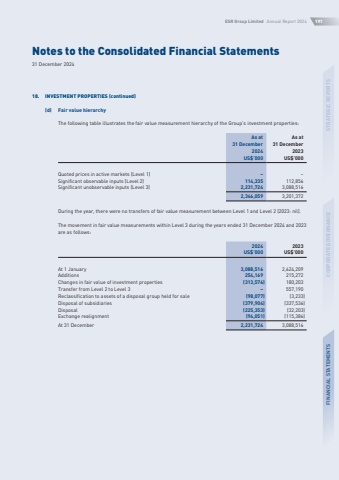

Notes to the Consolidated Financial Statements31 December 2024ESR Group Limited Annual Report 2024191STRATEGIC REPORTSCORPORATE GOVERNANCEFINANCIAL STATEMENTS18.INVESTMENT PROPERTIES (continued)(d)Fair value hierarchyThe following table illustrates the fair value measurement hierarchy of the Group%u2019s investment properties:As at31 December2024As at31 December2023US$%u2019000US$%u2019000Quoted prices in active markets (Level 1)%u2013%u2013Significant observable inputs (Level 2)114,335112,856Significant unobservable inputs (Level 3)2,231,7243,088,5162,346,0593,201,372During the year, there were no transfers of fair value measurement between Level 1 and Level 2 (2023: nil).The movement in fair value measurements within Level 3 during the years ended 31 December 2024 and 2023 are as follows:20242023US$%u2019000US$%u2019000At 1 January3,088,5162,624,209Additions254,169215,272Changes in fair value of investment properties(313,576)180,203Transfer from Level 2 to Level 3%u2013557,190Reclassification to assets of a disposal group held for sale(98,077)(3,233)Disposal of subsidiaries(379,904)(337,536)Disposal(225,353)(32,203)Exchange realignment(94,051)(115,386)At 31 December2,231,7243,088,516