Page 197 - Demo

P. 197

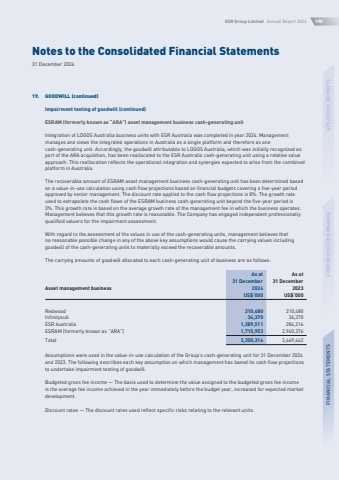

Notes to the Consolidated Financial Statements31 December 2024ESR Group Limited Annual Report 2024195STRATEGIC REPORTSCORPORATE GOVERNANCEFINANCIAL STATEMENTS19.GOODWILL (continued)Impairment testing of goodwill (continued)ESRAM (formerly known as %u201cARA%u201d) asset management business cash-generating unitIntegration of LOGOS Australia business units with ESR Australia was completed in year 2024. Management manages and views the integrated operations in Australia as a single platform and therefore as one cash-generating unit. Accordingly, the goodwill attributable to LOGOS Australia, which was initially recognized as part of the ARA acquisition, has been reallocated to the ESR Australia cash-generating unit using a relative value approach. This reallocation reflects the operational integration and synergies expected to arise from the combined platform in Australia.The recoverable amount of ESRAM asset management business cash-generating unit has been determined based on a value-in-use calculation using cash flow projections based on financial budgets covering a five-year period approved by senior management. The discount rate applied to the cash flow projections is 8%. The growth rate used to extrapolate the cash flows of the ESRAM business cash-generating unit beyond the five-year period is 3%. This growth rate is based on the average growth rate of the management fee in which the business operates. Management believes that this growth rate is reasonable. The Company has engaged independent professionally qualified valuers for the impairment assessment.With regard to the assessment of the values in use of the cash-generating units, management believes that no reasonable possible change in any of the above key assumptions would cause the carrying values including goodwill of the cash-generating units to materially exceed the recoverable amounts.The carrying amounts of goodwill allocated to each cash-generating unit of business are as follows:Asset management businessAs at31 December2024As at31 December2023US$%u2019000US$%u2019000Redwood210,480210,480Infinitysub34,37034,370ESR Australia1,389,511284,216ESRAM (formerly known as %u201cARA%u201d)1,715,9532,940,376Total3,350,3143,469,442Assumptions were used in the value-in-use calculation of the Group%u2019s cash-generating unit for 31 December 2024 and 2023. The following describes each key assumption on which management has based its cash flow projections to undertake impairment testing of goodwill.Budgeted gross fee income %u2014 The basis used to determine the value assigned to the budgeted gross fee income is the average fee income achieved in the year immediately before the budget year, increased for expected market development.Discount rates %u2014 The discount rates used reflect specific risks relating to the relevant units.