Page 200 - Demo

P. 200

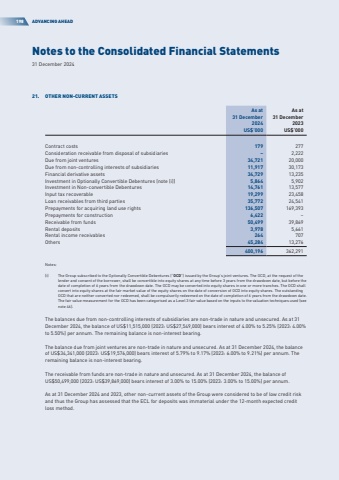

Notes to the Consolidated Financial Statements31 December 2024198ADVANCING AHEAD21.OTHER NON-CURRENT ASSETSAs at31 December2024As at31 December2023US$%u2019000US$%u2019000Contract costs179277Consideration receivable from disposal of subsidiaries%u20132,222Due from joint ventures34,72120,000Due from non-controlling interests of subsidiaries11,91730,173Financial derivative assets34,72913,235Investment in Optionally Convertible Debentures (note (i))5,8645,902Investment in Non-convertible Debentures14,76113,577Input tax recoverable19,29923,458Loan receivables from third parties35,77224,541Prepayments for acquiring land use rights136,507169,393Prepayments for construction6,422%u2013Receivable from funds50,49939,869Rental deposits3,9785,661Rental income receivables264707Others45,28413,276400,196362,291Notes:(i)The Group subscribed to the Optionally Convertible Debentures (%u201cOCD%u201d) issued by the Group%u2019s joint ventures. The OCD, at the request of the lender and consent of the borrower, shall be convertible into equity shares at any time before 3 years from the drawdown date, but before the date of completion of 6 years from the drawdown date. The OCD may be converted into equity shares in one or more tranches. The OCD shall convert into equity shares at the fair market value of the equity shares on the date of conversion of OCD into equity shares. The outstanding OCD that are neither converted nor redeemed, shall be compulsorily redeemed on the date of completion of 6 years from the drawdown date. The fair value measurement for the OCD has been categorised as a Level 3 fair value based on the inputs to the valuation techniques used (see note 46).The balances due from non-controlling interests of subsidiaries are non-trade in nature and unsecured. As at 31 December2024,thebalanceofUS$11,515,000(2023:US$27,549,000)bearsinterestof4.00%to5.25%(2023:4.00%to 5.50%) per annum. The remaining balance is non-interest bearing.The balance due from joint ventures are non-trade in nature and unsecured. As at 31 December 2024, the balance ofUS$34,341,000(2023:US$19,576,000)bearsinterestof5.79%to9.17%(2023:6.00%to9.21%)perannum.Theremaining balance is non-interest bearing.The receivable from funds are non-trade in nature and unsecured. As at 31 December 2024, the balance of US$50,499,000 (2023: US$39,869,000) bears interest of 3.00% to 15.00% (2023: 3.00% to 15.00%) per annum.As at 31 December 2024 and 2023, other non-current assets of the Group were considered to be of low credit risk and thus the Group has assessed that the ECL for deposits was immaterial under the 12-month expected credit loss method.