Page 201 - Demo

P. 201

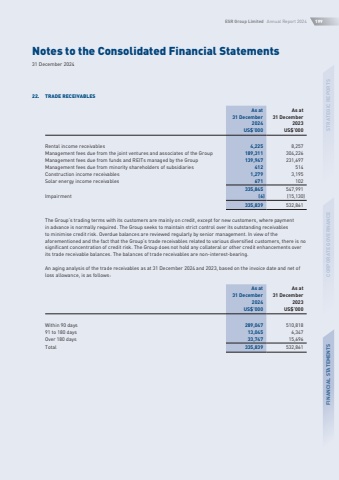

Notes to the Consolidated Financial Statements31 December 2024ESR Group Limited Annual Report 2024199STRATEGIC REPORTSCORPORATE GOVERNANCEFINANCIAL STATEMENTS22.TRADE RECEIVABLESAs at31 December2024As at31 December2023US$%u2019000US$%u2019000Rental income receivables4,2258,257Management fees due from the joint ventures and associates of the Group189,311304,226Management fees due from funds and REITs managed by the Group139,947231,697Management fees due from minority shareholders of subsidiaries412514Construction income receivables1,2793,195Solar energy income receivables671102335,845547,991Impairment(6)(15,130)335,839532,861The Group%u2019s trading terms with its customers are mainly on credit, except for new customers, where payment in advance is normally required. The Group seeks to maintain strict control over its outstanding receivables to minimise credit risk. Overdue balances are reviewed regularly by senior management. In view of the aforementioned and the fact that the Group%u2019s trade receivables related to various diversified customers, there is no significant concentration of credit risk. The Group does not hold any collateral or other credit enhancements over its trade receivable balances. The balances of trade receivables are non-interest-bearing.An aging analysis of the trade receivables as at 31 December 2024 and 2023, based on the invoice date and net of loss allowance, is as follows:As at 31 December 2024As at 31 December 2023US$%u2019000US$%u2019000Within 90 days289,047510,81891 to 180 days13,0456,347Over 180 days33,74715,696Total335,839532,861