Page 254 - Demo

P. 254

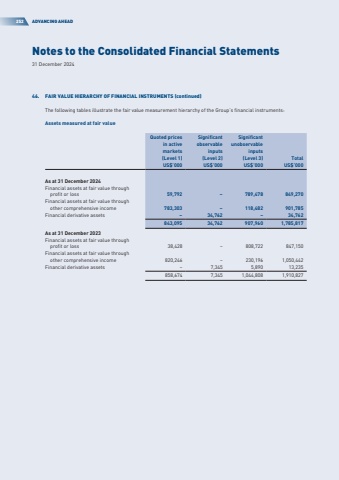

Notes to the Consolidated Financial Statements31 December 2024252ADVANCING AHEAD46.FAIR VALUE HIERARCHY OF FINANCIAL INSTRUMENTS (continued)The following tables illustrate the fair value measurement hierarchy of the Group%u2019s financial instruments:Assets measured at fair valueQuoted prices in active markets (Level 1)Significant observable inputs (Level 2)Significant unobservable inputs (Level 3)TotalUS$%u2019000US$%u2019000US$%u2019000US$%u2019000As at 31 December 2024Financial assets at fair value through profit or loss59,792%u2013789,478849,270Financial assets at fair value through other comprehensive income783,303%u2013118,482901,785Financial derivative assets%u201334,762%u201334,762843,09534,762907,9601,785,817As at 31 December 2023Financial assets at fair value through profit or loss38,428808,722847,150Financial assets at fair value through other comprehensive income820,246230,1961,050,442Financial derivative assets7,3455,89013,235858,6747,3451,044,8081,910,827