Page 255 - Demo

P. 255

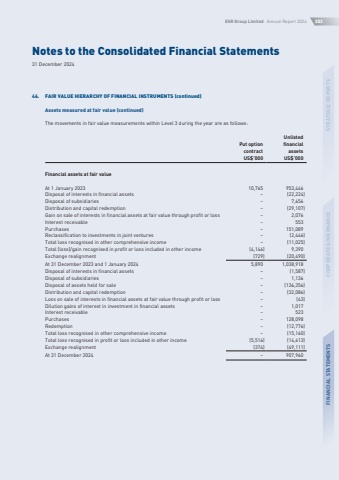

Notes to the Consolidated Financial Statements31 December 2024ESR Group Limited Annual Report 2024253STRATEGIC REPORTSCORPORATE GOVERNANCEFINANCIAL STATEMENTS46.FAIR VALUE HIERARCHY OF FINANCIAL INSTRUMENTS (continued)Assets measured at fair value (continued)The movements in fair value measurements within Level 3 during the year are as follows:Put option contractUnlisted financial assetsUS$%u2019000US$%u2019000Financial assets at fair valueAt 1 January 202310,765953,446Disposal of interests in financial assets%u2013(22,224)Disposal of subsidiaries%u20137,656Distribution and capital redemption%u2013(29,107)Gain on sale of interests in financial assets at fair value through profit or loss%u20132,076Interest receivable%u2013553Purchases%u2013151,089Reclassification to investments in joint ventures%u2013(2,446)Total loss recognised in other comprehensive income%u2013(11,025)Total (loss)/gain recognised in profit or loss included in other income(4,146)9,390Exchange realignment(729)(20,490)At 31 December 2023 and 1 January 20245,8901,038,918Disposal of interests in financial assets%u2013(1,587)Disposal of subsidiaries%u20131,136Disposal of assets held for sale%u2013(136,356)Distribution and capital redemption%u2013(32,086)Loss on sale of interests in financial assets at fair value through profit or loss%u2013(43)Dilution gains of interest in investment in financial assets%u20131,017Interest receivable%u2013523Purchases%u2013128,098Redemption%u2013(12,776)Total loss recognised in other comprehensive income%u2013(15,160)Total loss recognised in profit or loss included in other income(5,516)(14,613)Exchange realignment(374)(49,111)At 31 December 2024%u2013907,960