Page 54 - Demo

P. 54

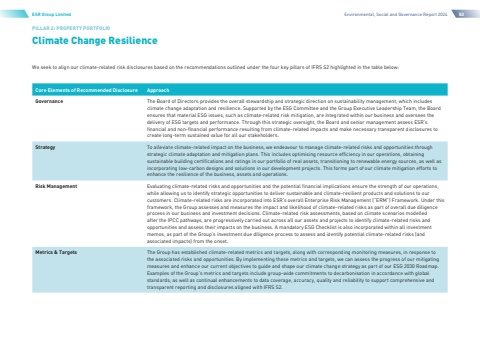

Climate Change ResiliencePILLAR 2: PROPERTY PORTFOLIOESR Group LimitedEnvironmental, Social and Governance Report 202453We seek to align our climate-related risk disclosures based on the recommendations outlined under the four key pillars of IFRS S2 highlighted in the table beloCore Elements of Recommended DisclosureApproachGovernanceThe Board of Directors provides the overall stewardship and strategic direction on sustainability management, which includes climate change adaptation and resilience. Supported by the ESG Committee and the Group Executive Leadership Team, the Board ensures that material ESG issues, such as climate-related risk mitigation, are integrated within our business and oversees the delivery of ESG targets and performance. Through this strategic oversight, the Board and senior management assess ESR%u2019s financial and non-financial performance resulting from climate-related impacts and make necessary transparent disclosures to create long-term sustained value for all our stakeholders.StrategyTo alleviate climate-related impact on the business, we endeavour to manage climate-related risks and opportunities through strategic climate adaptation and mitigation plans. This includes optimising resource efficiency in our operations, obtaining sustainable building certifications and ratings in our portfolio of real assets, transitioning to renewable energy sources, as well as incorporating low-carbon designs and solutions in our development projects. This forms part of our climate mitigation efforts to enhance the resilience of the business, assets and operations.Risk ManagementEvaluating climate-related risks and opportunities and the potential financial implications ensure the strength of our operations, while allowing us to identify strategic opportunities to deliver sustainable and climate-resilient products and solutions to our customers. Climate-related risks are incorporated into ESR%u2019s overall Enterprise Risk Management (%u201cERM%u201d) Framework. Under this framework, the Group assesses and measures the impact and likelihood of climate-related risks as part of overall due diligence process in our business and investment decisions. Climate-related risk assessments, based on climate scenarios modelled after the IPCC pathways, are progressively carried out across all our assets and projects to identify climate-related risks and opportunities and assess their impacts on the business. A mandatory ESG Checklist is also incorporated within all investment memos, as part of the Group%u2019s investment due diligence process to assess and identify potential climate-related risks (and associated impacts) from the onset.Metrics & TargetsThe Group has established climate-related metrics and targets, along with corresponding monitoring measures, in response to the associated risks and opportunities. By implementing these metrics and targets, we can assess the progress of our mitigating measures and enhance our current objectives to guide and shape our climate change strategy as part of our ESG 2030 Roadmap. Examples of the Group%u2019s metrics and targets include group-wide commitments to decarbonisation in accordance with global standards, as well as continual enhancements to data coverage, accuracy, quality and reliability to support comprehensive and transparent reporting and disclosures aligned with IFRS S2.