Page 55 - Demo

P. 55

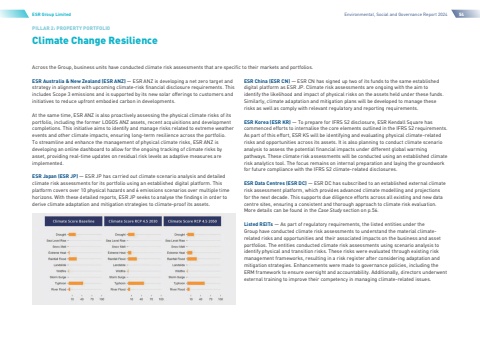

Climate Change ResiliencePILLAR 2: PROPERTY PORTFOLIOESR Group LimitedEnvironmental, Social and Governance Report 202454ESR China (ESR CN) %u2014 ESR CN has signed up two of its funds to the same established digital platform as ESR JP. Climate risk assessments are ongoing with the aim to identify the likelihood and impact of physical risks on the assets held under these funds. Similarly, climate adaptation and mitigation plans will be developed to manage these risks as well as comply with relevant regulatory and reporting requirements.ESR Korea (ESR KR) %u2014 To prepare for IFRS S2 disclosure, ESR Kendall Square has commenced efforts to internalise the core elements outlined in the IFRS S2 requirements. As part of this effort, ESR KS will be identifying and evaluating physical climate-related risks and opportunities across its assets. It is also planning to conduct climate scenario analysis to assess the potential financial impacts under different global warming pathways. These climate risk assessments will be conducted using an established climate risk analytics tool. The focus remains on internal preparation and laying the groundwork for future compliance with the IFRS S2 climate-related disclosures.ESR Data Centres (ESR DC) %u2014 ESR DC has subscribed to an established external climate risk assessment platform, which provides advanced climate modelling and projections for the next decade. This supports due diligence efforts across all existing and new data centre sites, ensuring a consistent and thorough approach to climate risk evaluation. More details can be found in the Case Study section on p.56.Listed REITs %u2014 As part of regulatory requirements, the listed entities under the Group have conducted climate risk assessments to understand the material climaterelated risks and opportunities and their associated impacts on the business and asset portfolios. The entities conducted climate risk assessments using scenario analysis to identify physical and transition risks. These risks were evaluated through existing risk management frameworks, resulting in a risk register after considering adaptation and mitigation strategies. Enhancements were made to governance policies, including the ERM framework to ensure oversight and accountability. Additionally, directors underwent external training to improve their competency in managing climate-related issues.ESR Australia & New Zealand (ESR ANZ)%u2014 ESR ANZ is developing a net zero target and strategy in alignment with upcoming climate-risk financial disclosure requirements. This includes Scope 3 emissions and is supported by its new solar offerings to customers and initiatives to reduce upfront embodied carbon in developments.At the same time, ESR ANZ is also proactively assessing the physical climate risks of its portfolio, including the former LOGOS ANZ assets, recent acquisitions and development completions. This initiative aims to identify and manage risks related to extreme weather events and other climate impacts, ensuring long-term resilience across the portfolio. To streamline and enhance the management of physical climate risks, ESR ANZ is developing an online dashboard to allow for the ongoing tracking of climate risks by asset, providing real-time updates on residual risk levels as adaptive measures are implemented.ESR Japan (ESR JP) %u2014 ESR JP has carried out climate scenario analysis and detailed climate risk assessments for its portfolio using an established digital platform. This platform covers over 10 physical hazards and 6 emissions scenarios over multiple time horizons. With these detailed reports, ESR JP seeks to analyse the findings in order to derive climate adaptation and mitigation strategies to climate-proof its assets.Across the Group, business units have conducted climate risk assessments that are specific to their markets and portfolios.