Page 202 - Demo

P. 202

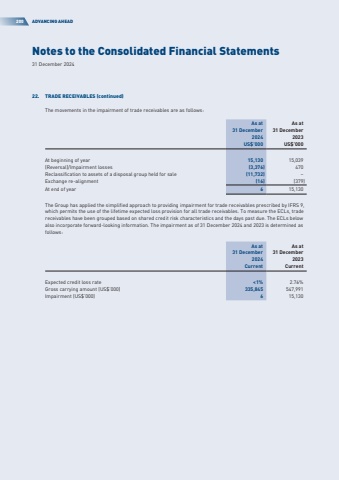

Notes to the Consolidated Financial Statements31 December 2024200ADVANCING AHEAD22.TRADE RECEIVABLES (continued)The movements in the impairment of trade receivables are as follows:As at 31 December 2024As at 31 December 2023US$%u2019000US$%u2019000At beginning of year15,13015,039(Reversal)/Impairment losses(3,376)470Reclassification to assets of a disposal group held for sale(11,732)%u2013Exchange re-alignment(16)(379)At end of year615,130The Group has applied the simplified approach to providing impairment for trade receivables prescribed by IFRS 9, which permits the use of the lifetime expected loss provision for all trade receivables. To measure the ECLs, trade receivables have been grouped based on shared credit risk characteristics and the days past due. The ECLs below also incorporate forward-looking information. The impairment as of 31 December 2024 and 2023 is determined as follows:As at 31 December 2024As at 31 December 2023CurrentCurrentExpected credit loss rate<1%2.76%Gross carrying amount (US$%u2019000)335,845547,991Impairment (US$%u2019000)615,130