Page 203 - Demo

P. 203

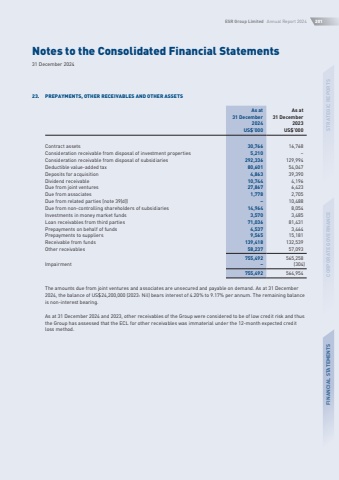

Notes to the Consolidated Financial Statements31 December 2024ESR Group Limited Annual Report 2024201STRATEGIC REPORTSCORPORATE GOVERNANCEFINANCIAL STATEMENTS23.PREPAYMENTS, OTHER RECEIVABLES AND OTHER ASSETSAs at 31 December 2024As at 31 December 2023US$%u2019000US$%u2019000Contract assets30,76616,768Consideration receivable from disposal of investment properties5,210%u2013Consideration receivable from disposal of subsidiaries292,336129,994Deductible value-added tax80,60154,047Deposits for acquisition4,86339,390Dividend receivable10,7444,196Due from joint ventures27,8676,423Due from associates1,7782,705Due from related parties (note 39(d))%u201310,488Due from non-controlling shareholders of subsidiaries14,9648,054Investments in money market funds3,5703,485Loan receivables from third parties71,03681,431Prepayments on behalf of funds4,5373,464Prepayments to suppliers9,56515,181Receivable from funds139,418132,539Other receivables58,23757,093755,492565,258Impairment%u2013(304)755,492564,954The amounts due from joint ventures and associates are unsecured and payable on demand. As at 31 December 2024,thebalanceofUS$24,200,000(2023:Nil)bearsinterestof4.20%to9.17%perannum.Theremainingbalanceis non-interest bearing.As at 31 December 2024 and 2023, other receivables of the Group were considered to be of low credit risk and thus the Group has assessed that the ECL for other receivables was immaterial under the 12-month expected credit loss method.